Investment Market Update

NOVEMBER 2024

What developments have unfolded in local and global markets throughout the month of November?

52

52

Record highs by the S&P 500 this year

$10,8 billion

$10,8 billion

Spent online in the US on Black Friday

2 600%

2 600%

Nvidia’s earnings increase since Chat GPT launched

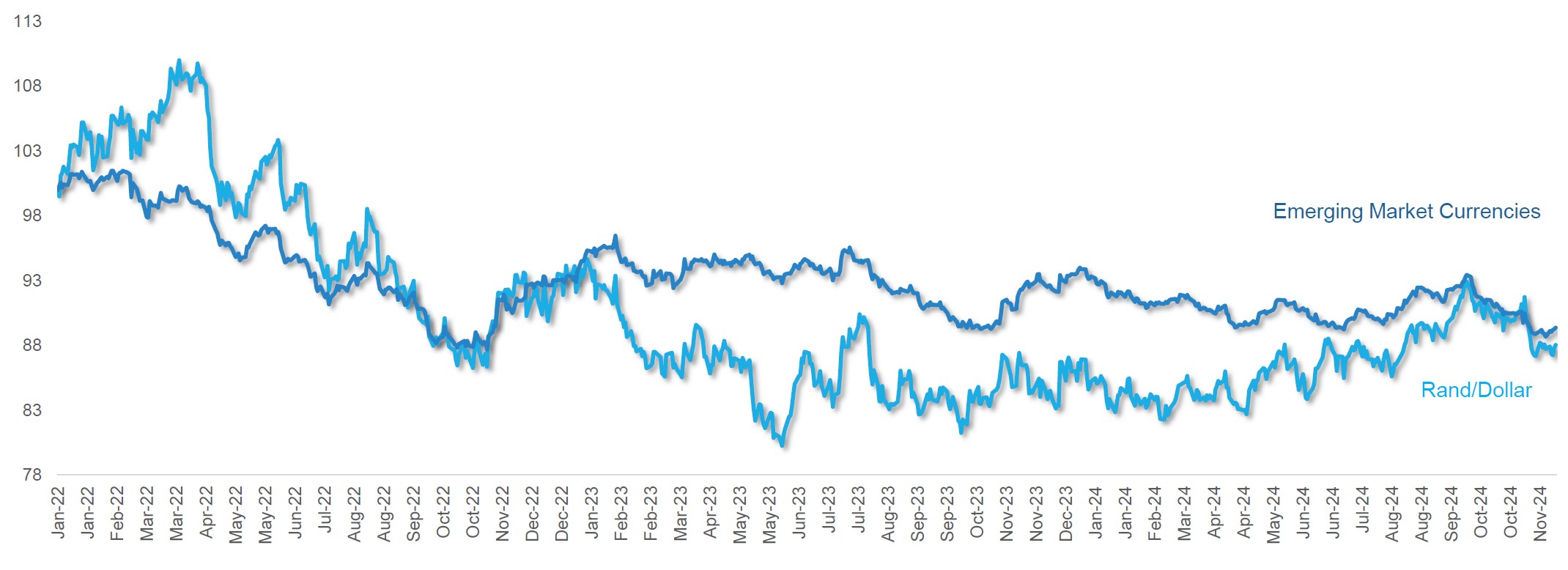

EMERGING MARKETS VS THE RAND

EMERGING MARKETS VS THE RAND

US DOLLAR VS THE RAND

US DOLLAR VS THE RAND

EMERGING MARKET EXCHANGE RATE VS USD

EMERGING MARKET EXCHANGE RATE VS USD

GLOBAL MARKET

_______________________

In November, the U.S. election concluded with Donald Trump confirmed as president-elect. What was initially anticipated to be a close contest turned into a decisive victory for the Republicans, who secured the Electoral College, the popular vote, the House of Representatives, the Senate, and all seven battleground states of the election year.

ANALYTICS - NOVEMBER COMMENTARY:

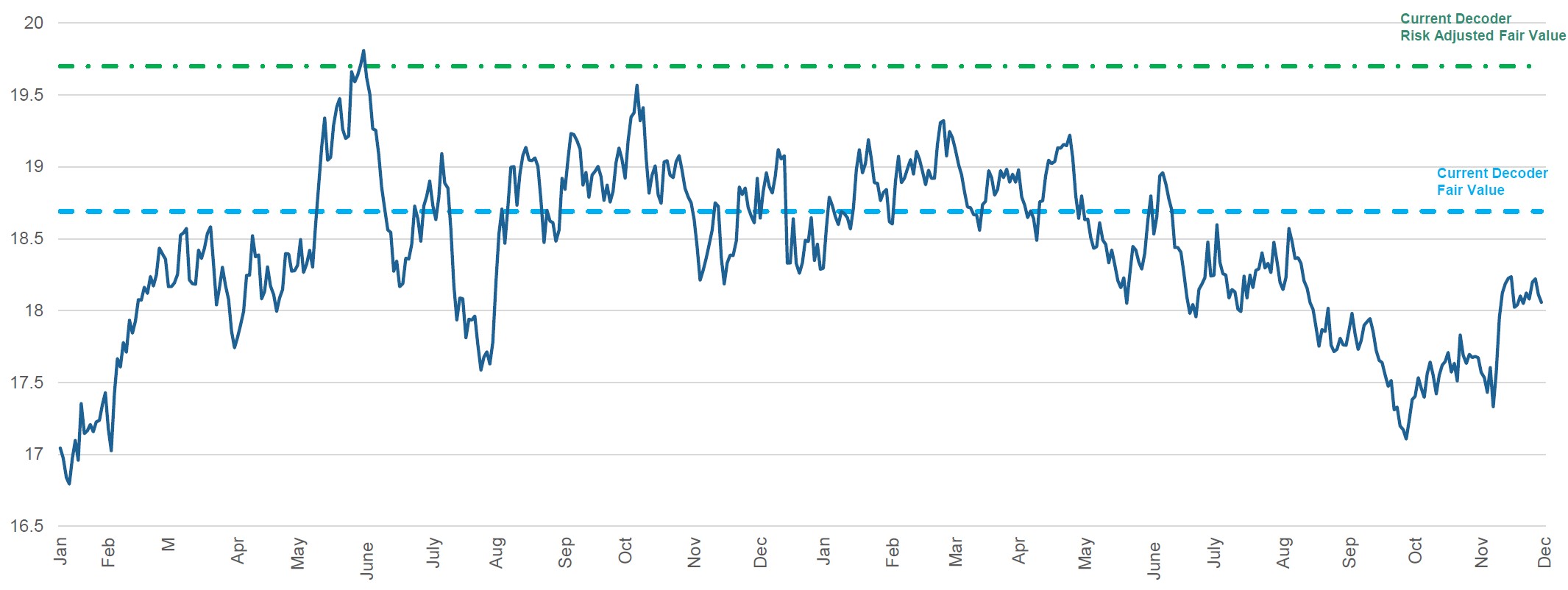

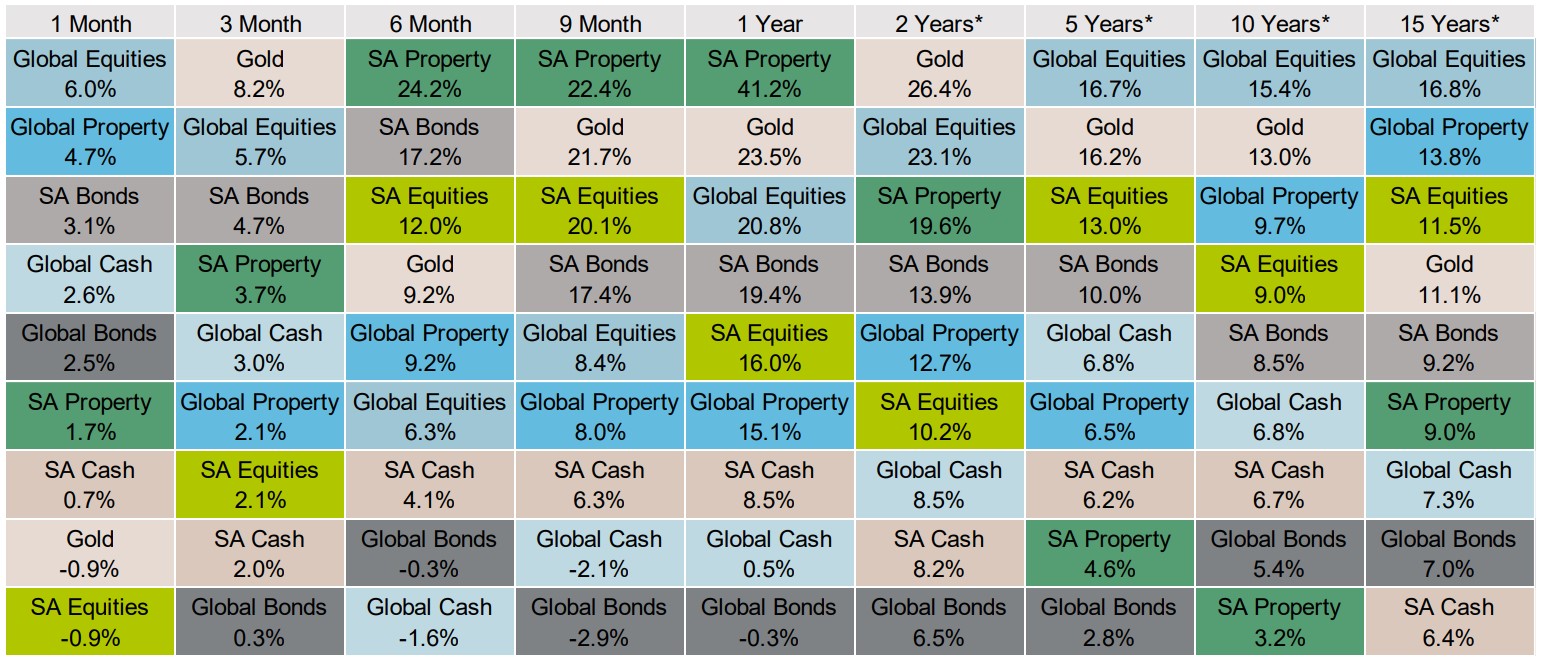

SMARTIE BOX IN RANDS:

LOCAL MARKETS

__________________________

South African equities experienced another challenging month, largely due to falling commodity prices, which weighed on resource stocks and pulled the index lower. In contrast, retailers delivered strong performance during the same period. Headline inflation in South Africa decreased to 2.8% in October, prompting the South African Reserve Bank (SARB) to cut interest rates by an additional 25 basis points at the November Monetary Policy Committee meeting.

The SARB’s composite leading indicator recorded its sixth consecutive month of year-on-year growth, driven by optimism surrounding the Government of National Unity (GNU), a stronger Rand, the absence of load-shedding, and other positive factors.

Lower oil prices and a stronger currency have contributed to subdued inflation, with October’s annualized inflation rate at 2.8%, below the SARB’s target band of 3-6%. Domestic demand remains weak, and the Reserve Bank’s restrictive policy rate is unlikely to stimulate significant growth. If inflation stays low, there may be increasing pressure on the SARB to adopt more aggressive rate cuts.

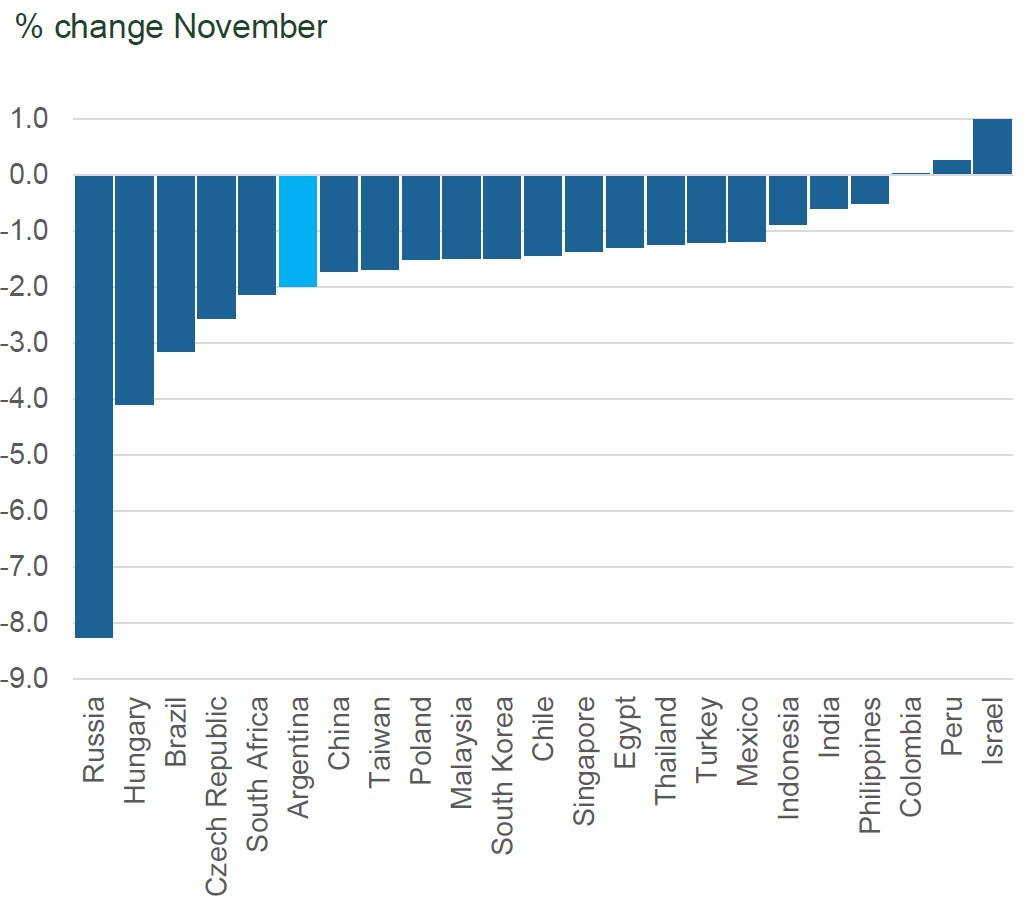

Since Donald Trump’s victory in the U.S. presidential election, markets have grown more concerned about global trade and the potential impact of tariffs. This uncertainty has strengthened the U.S. Dollar and weakened emerging market currencies. For South Africa, ABSA research suggests that losing participation in the Africa Growth and Opportunities Act (AGOA) would have limited overall economic impact.

In a positive development, S&P Global revised its outlook on South African government debt from “stable” to “positive.” While this is a step toward regaining investment-grade status, significant progress is still needed before rating agencies consider upgrading the country’s credit rating.

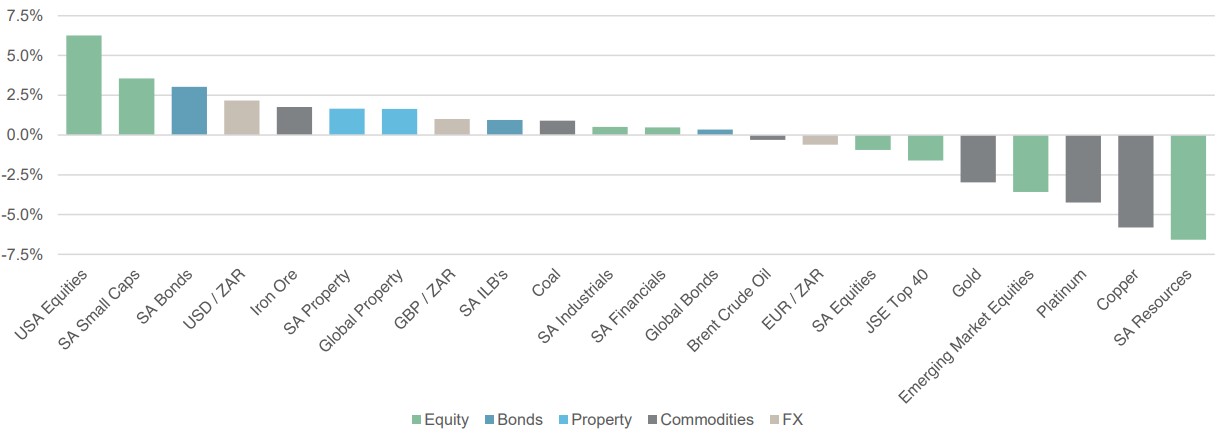

- The JSE All Share Index slipped down 0.9% for the second month in a row.

- Financials (up 0.5%) and Industrials (up 0.5%) were up slightly while Resources (down 6.6%) felt the effect of weaker commodity prices.

- Small-caps (up 3.6%) held up well for the month while Mid-caps (down 0.1%) and Large-caps (down 1.6%) ended the month in the negative.

- Both the S&P SA REIT sector (up 1.2%) and the SA Listed Property sector (up 1.7%) showed some growth over the month.

- SA Nominal Bonds (up 3.0%) and Inflation Linked Bonds (up 0.9%) benefited from improved fiscal outlook and optimism.

- Developed Market Equities outperformed their Emerging Market peers in US Dollar terms, with the MSCI World Index up 4.6% and the MSCI Emerging Market Index down 3.6%.

- Relative to the US Dollar (Rand depreciated 2.2%), the Euro (Rand appreciated 0.6%) and the Pound Sterling (Rand depreciated 1.0%).

- Commodities prices broadly fell in November, with Gold (down 3.0%), Platinum (down 4.2%) and Brent Crude (down 0.3%).

MONTHLY RETURNS: