Investment Market Update

DECEMBER 2024

What developments have unfolded in local and global markets throughout the month of December?

$557.16 billion

$557.16 billion

Total amount Americans gave to charitable causes over the year

56%

56%

Of the average Americans holliday budget is allocated to gifts

518 000

518 000

Number of visitors arriving at cape town airport in December 2023, with a projected 13% increase in arrivals for December 2024

GLOBAL MARKET

_______________________

Global Markets Face Shifts Amid Fed’s Hawkish Tone and China’s Policy Adjustments.

ANALYTICS - DECEMBER COMMENTARY:

SMARTIE BOX IN RANDS:

LOCAL MARKETS

__________________________

Emerging Markets Shine in December Amid South African Challenges.

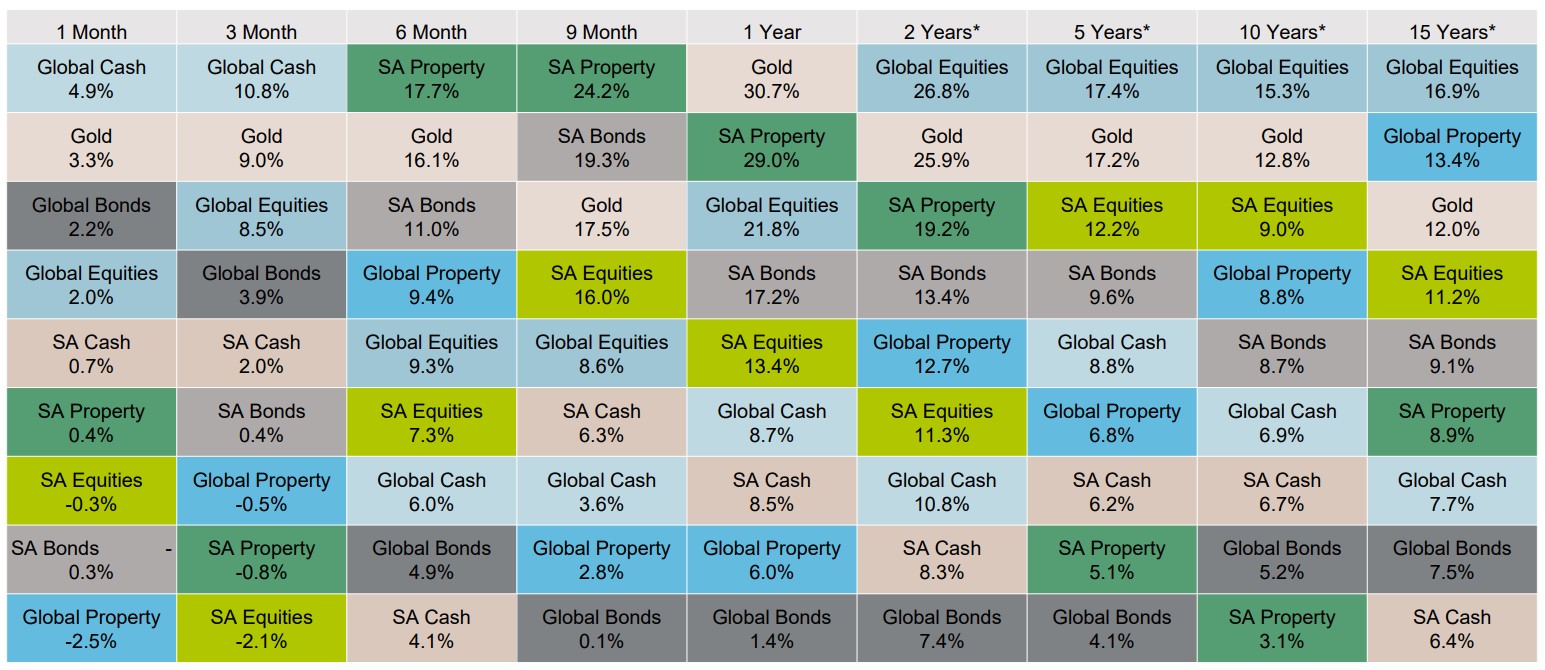

Emerging Market (EM) equities outperformed their Developed Market counterparts in December, capping a strong year for the asset class. While South African equities and bonds lagged their EM peers, they still delivered solid year-on-year returns. The All Bond Index (ALBI) posted a rare negative return in December but ended 2024 with a 17.2% gain, its best annual performance since 2003. Inflation-linked bonds were the weakest domestic asset class, impacted by slowing inflation, poor carry, and rising real yields.

The South African Reserve Bank (SARB) cut interest rates by 25 basis points for the second consecutive meeting, lowering the repo rate to 7.75%. With inflation expected to remain near the lower bound of the 3–6% target range, the SARB has room for further monetary easing in the coming months.

On the energy front, Eskom reconnected the second unit of the Koeberg nuclear power plant to the national grid after extensive refurbishment. This achievement marks nine months of uninterrupted power supply, bolstering business confidence and improving South Africa’s electricity reliability.

The South African rand weakened to 18.9 per USD in December, its lowest level since June, driven by a stronger dollar. Following Donald Trump’s re-election as U.S. president, the rand experienced a significant pullback, ending 2024 down approximately 3% year-to-date.

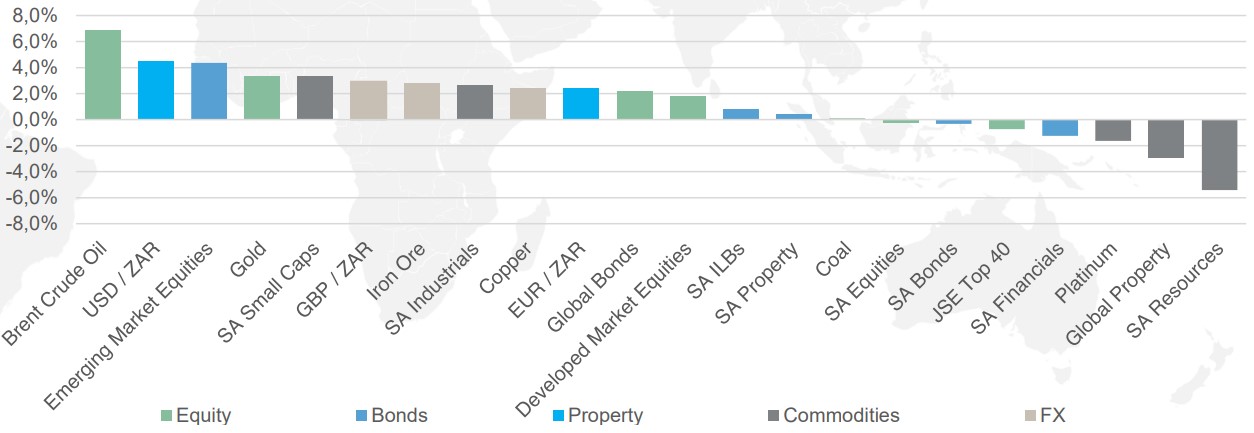

- The JSE All Share Index declined by 0.3% for the month.

- Industrials saw positive performance (up 2.7%) for the month, while Resources (down 5.4%) and financials (down 1.2%) faced challenges.

- Small-caps (up 3.3%) held up well for the month while Mid-caps (down 1.9%) and Large-caps (down 0.7%) ended the month in the negative.

- Both the S&P SA REIT sector (up 0.5%) and the SA Listed Property sector (up 0.4%) showed some growth over the month.

- SA Nominal Bonds (down 0.3%) recorded a rare negative return in December, marking only the fourth instance of such a decline in the past 24 years. In contrast Inflation Linked Bonds (up 0.8%) saw a modest positive return.

- Developed Market Equities underperformed their Emerging Market peers in US Dollar terms, with the MSCI World Index down 2.6% and the MSCI Emerging Market Index down 0.1%.

- Relative to the US Dollar (Rand depreciated 4.5%), the Euro (Rand depreciated 2.4%) and the Pound Sterling (Rand depreciated 2.9%).

- Commodities prices generally declined in December, except for oil. Gold (down 1.0%), Platinum (down 5.8%) and Brent Crude (up 2.3%).

MONTHLY RETURNS: