Investment Market Update

AUGUST 2024

What developments have unfolded in local and global markets throughout the month of August?

154 Days

154 Days

Consecutively without loadshedding

4.6%

4.6%

Year on Year SA Inflation

+126%

+126%

Nvidea Revenue Growth From 2023 to 2024 (so far)

EMERGING MARKETS VS THE RAND

EMERGING MARKETS VS THE RAND

US DOLLAR VS THE RAND

US DOLLAR VS THE RAND

EMERGING MARKET EXCHANGE RATE VS USD

EMERGING MARKET EXCHANGE RATE VS USD

GLOBAL MARKET

_______________________

Global equity markets started August on a rocky note, as weaker-than-expected U.S. job creation, a rise in the unemployment rate, erratic earnings reports from major tech firms, and sluggish manufacturing data contributed to early losses. Geopolitical uncertainties added further pressure to market volatility, which is a normal and recurring phenomenon.

ANALYTICS AUGUST COMMENTARY:

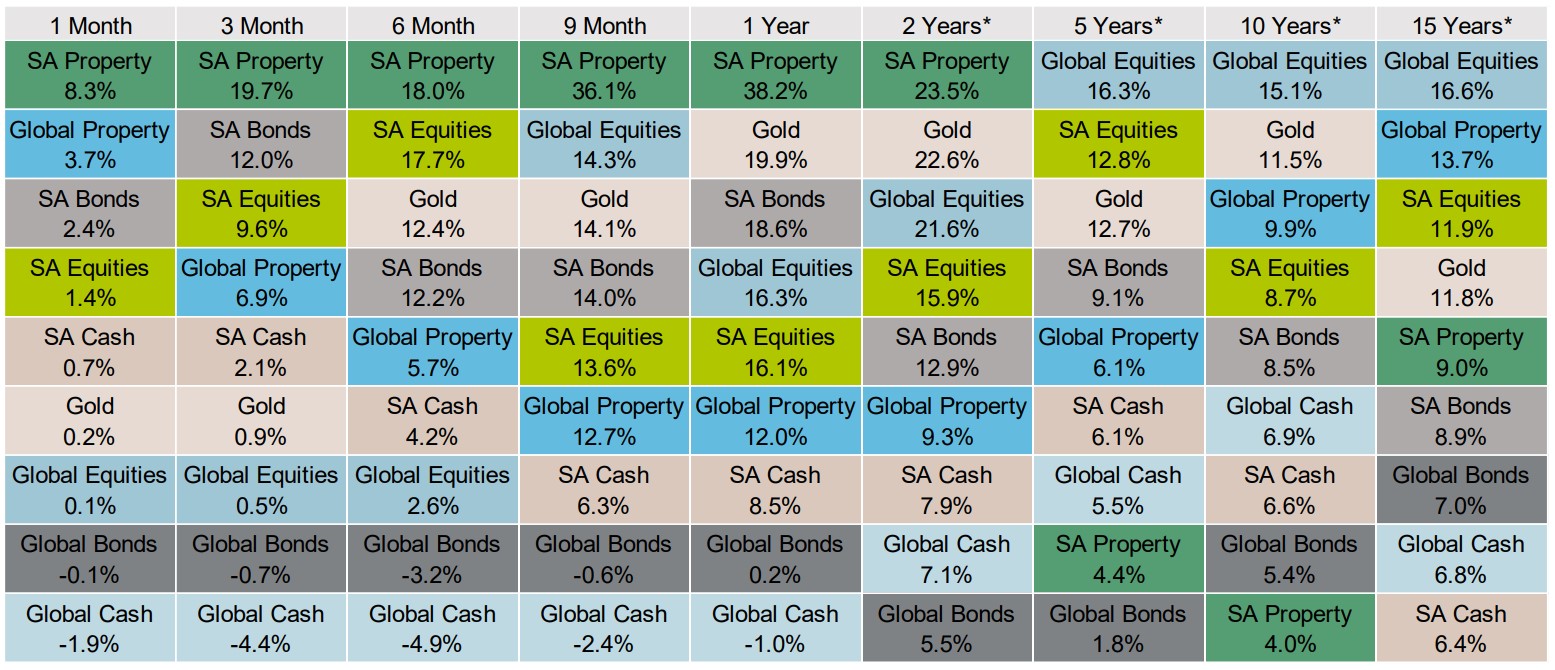

SMARTIE BOX IN RANDS:

LOCAL MARKETS

__________________________

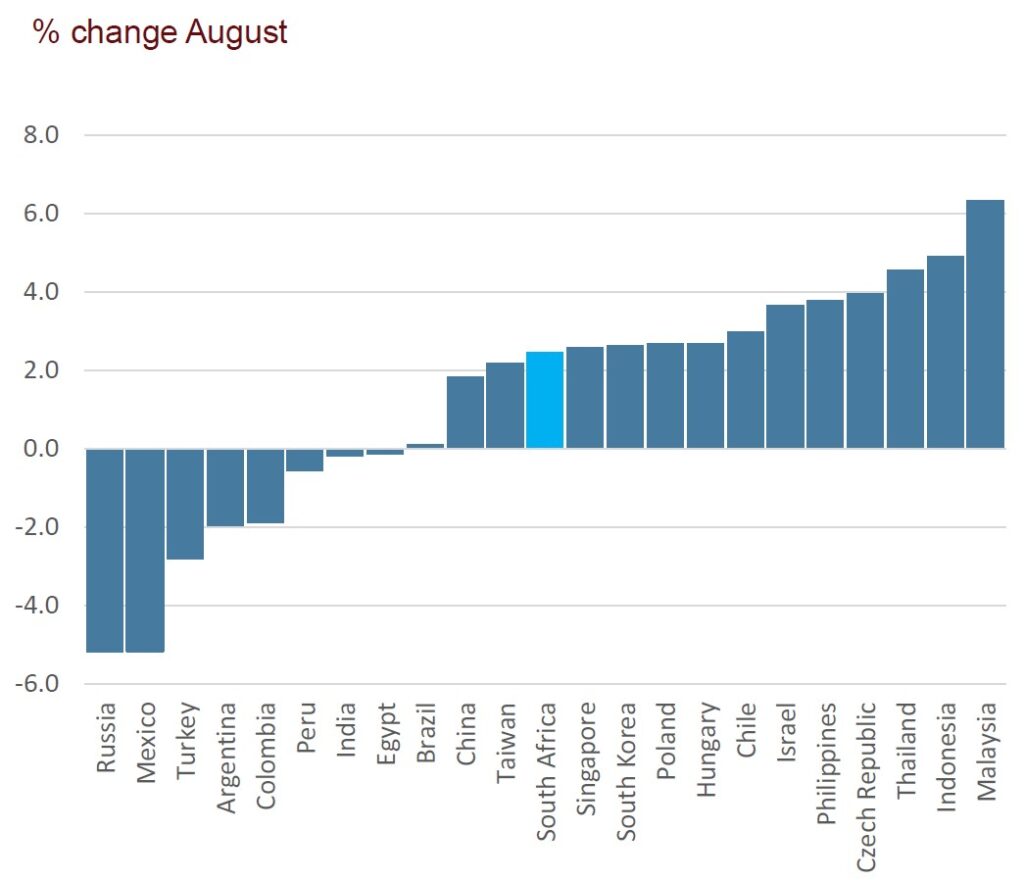

South African bonds and equities continued to benefit from improving foreign sentiment in August, outperforming their emerging market counterparts.

July’s inflation data came in lower than expected, with headline inflation at 4.6% compared to the market consensus of 4.8%, and core inflation slowing to 4.3%, below the 4.5% midpoint. This deceleration occurred a full quarter earlier than forecasted by the South African Reserve Bank (SARB). Attention is now focused on the upcoming Monetary Policy Committee (MPC) meeting in September, where investors are eager to see if the long-anticipated cycle of interest rate cuts will begin.

The rand strengthened further against the US dollar, marking a nearly 6% appreciation over the past three months and outperforming other major emerging market currencies. Meanwhile, oil prices continued to decline, now almost 10% lower than they were a year ago. In contrast, gold hit new record highs, driven by ongoing central bank purchases, with a remarkable 30% gain over the past year.

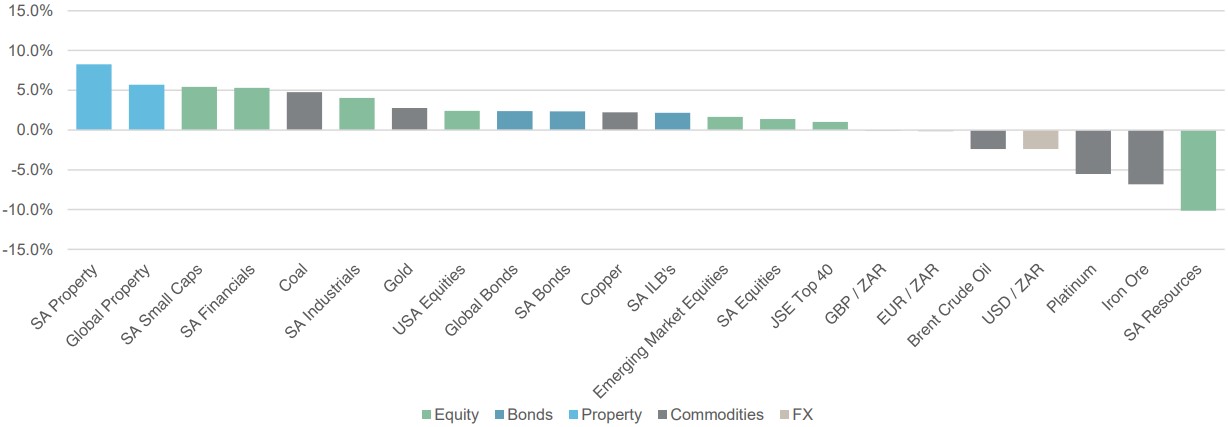

- The JSE All Share Index closed higher (up 1.4%) for its sixth consecutive month.

- Financials (up 5.3%), Industrials (up 4.0%) performed well while Resources (down 10.1%) struggled due to softer commodity prices.

- Small-caps (up 5.4%), Mid-caps (up 0.4%), and Large-caps (up 1.0%) all ended the month higher.

- The S&P SA REIT sector (up 10.9%) and the SA Listed Property sector (up 8.3%) benefited from positive sentiment and rate cut prospects.

- SA Nominal Bonds (up 2.4%) and Inflation Linked Bonds (up 2.2%) continued their positive momentum.

- Developed Market Equities trounced their Emerging Market peers in US Dollar terms, with the MSCI World Index up 2.7% and the MSCI Emerging Market Index continuing to edge higher, up 1.6%.

- The Rand had a strong month, as sentiment towards South Africa remained positive, and the dollar weakened. Relative to the US Dollar (Rand appreciated 2.4%), the Euro (Rand appreciated 0.2%) and the Pound Sterling (Rand appreciated 0.1%).

- Commodities were a mixed bag in August. Gold (up 2.8%) rose higher, while Platinum (down 5.50%) dropped, and Brent Crude (down 2.4%) continued to weaken.

MONTHLY RETURNS: