Investment Market Update

JULY 2024

What developments have unfolded in local and global markets throughout the month of July?

KEY NUMBERS

127 Days

127 Days

Consecutively without loadshedding

Paris is the 30th

Paris is the 30th

Summer Olympics Event (1916, 1940, 1944 were cancelled)

0.25%

0.25%

Rate hike from the Bank of Japan

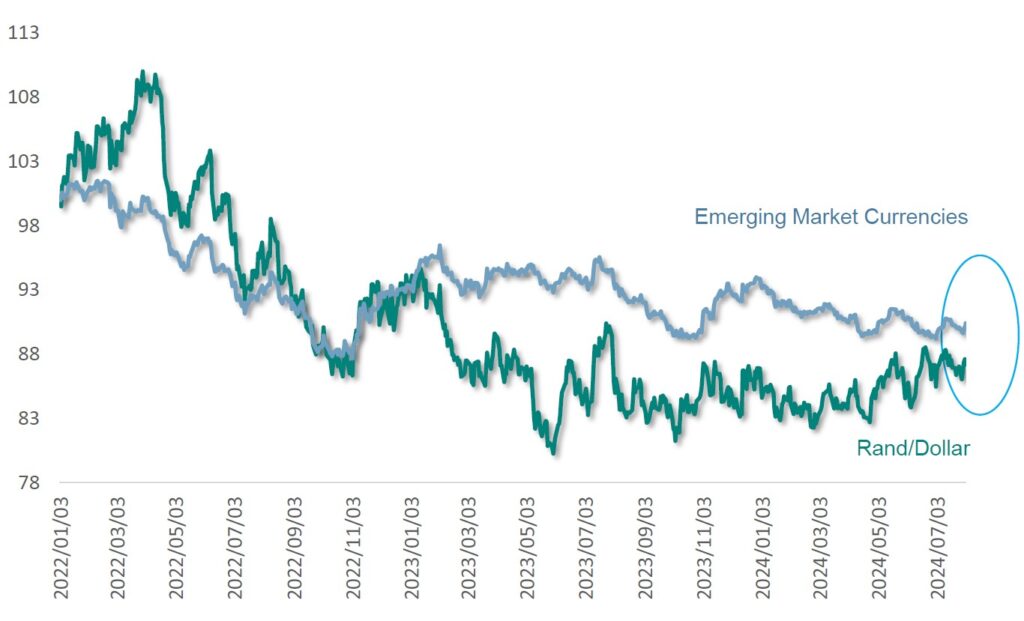

EXCHANGE RATES

EMERGING MARKET CURRENCIES VS THE RAND

EMERGING MARKET CURRENCIES VS THE RAND

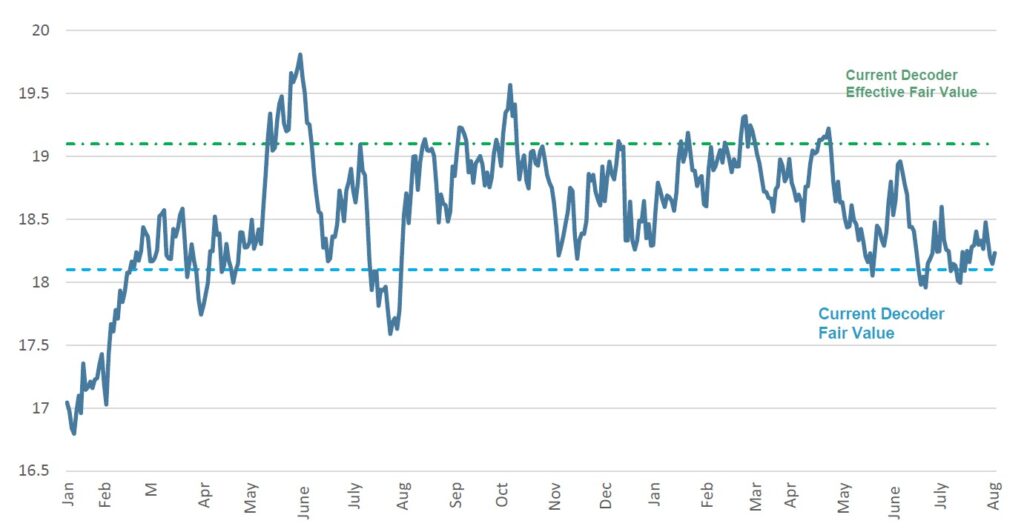

US DOLLAR VS THE RAND

US DOLLAR VS THE RAND

EMERGING MARKET EXCHANGE RATE VS USD

EMERGING MARKET EXCHANGE RATE VS USD

GLOBAL MARKET

_______________________

Developed market equities generally performed well in July, with most major indices closing in positive territory, except for the Nasdaq, which was weighed down by underwhelming earnings in the US tech sector.

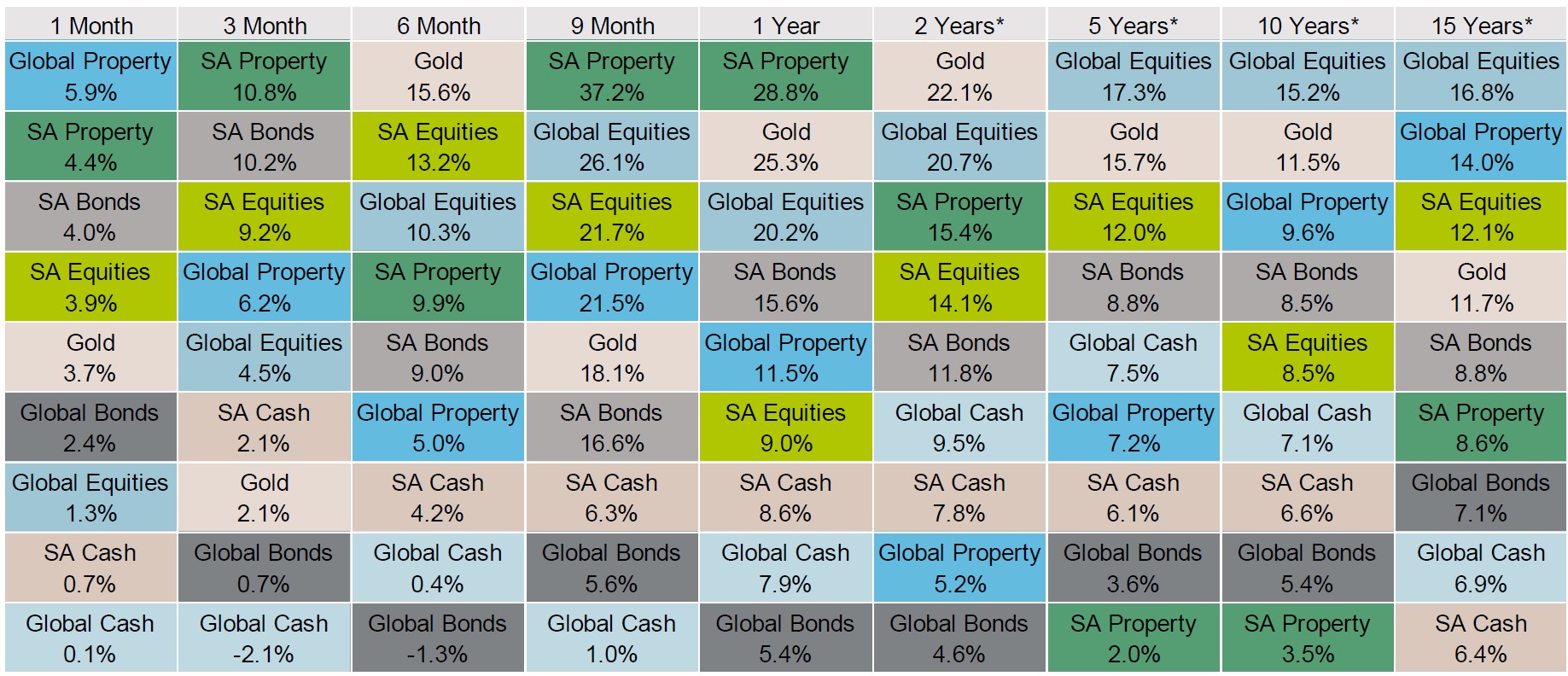

SMARTIE BOX IN RANDS:

LOCAL MARKETS

__________________________

South Africa enjoyed another strong month of gains, outperforming both emerging and developed markets across all asset classes. Bonds continued to rally as political risks that had been priced in failed to materialize, leading to foreign investors purchasing R19.7 billion worth of South African debt instruments in July.

The stability of the Government of National Unity has bolstered investor confidence, further supporting local equities, with all three major sectors posting gains. Financials benefited from the increased likelihood of rate cuts, while resources were boosted by a rise in gold prices.

At its July meeting, the Monetary Policy Committee (MPC) opted to keep the repo rate steady at 8.25%. The decision was not unanimous, however, as two of the six members voted for a 25bps cut, signaling that the start of a rate-cutting cycle could be on the horizon sooner than anticipated. Market expectations now point to a potential 25bps cut in September, as inflation gradually moves closer to the central bank’s midpoint target.

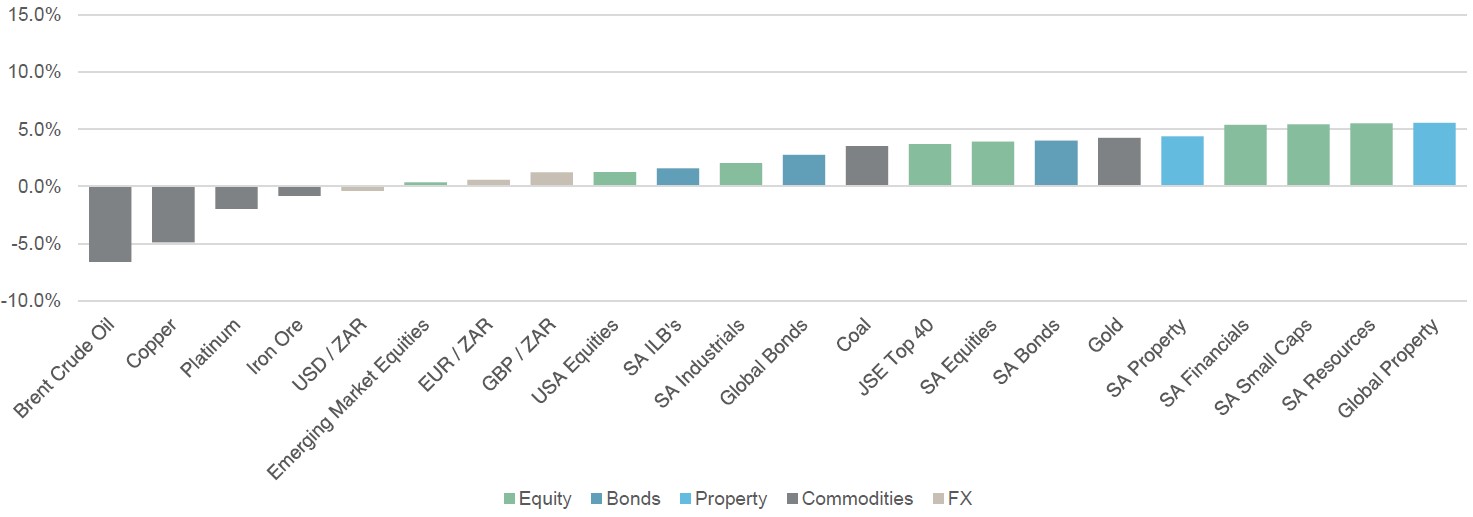

MOVEMENTS

- The JSE All Share Index closed higher (up 3.9%) for its fifth consecutive month, starting the second half of the year on the right foot.

- Financials (up 5.4%) , Industrials (up 2.0%) and Resources (up 5.5%) all contributed positively to the broader bourse.

- Small-caps (up 5.4%) and Mid-caps (up 5.1%) rocketed higher, and Large-caps (up 3.7%) followed close behind.

- The S&P SA REIT sector (up 3.9%) and the SA Listed Property sector (up 4.4%) each gained, as local growth-on continued.

- SA Nominal Bonds (up 4.0%) strengthened, and Inflation Linked Bonds (up 1.6%) inched higher.

- Developed Market Equities trounced their Emerging Market peers in US Dollar terms, with the MSCI World Index up 1.8% and the MSCI Emerging Market Index closing slightly over the zero line,up 0.4%.

- The Rand had a mixed month, as sentiment towards South Africa remained positive, the dollar weakened and the pound gained ground. Relative to the US Dollar (Rand appreciated 0.4%), the Euro (Rand depreciated 0.6%) and the Pound Sterling (Rand depreciated 1.2%).

- Commodities were another mixed basket in July. Gold (up 4.2%) rose higher, awhile Platinum (down 2.0%) dropped, and Brent Crude (down 6.6%) sold off.

MONTHLY RETURNS: