Investment Market Update

JUNE 2024

What developments have unfolded in local and global markets throughout the month of June?

KEY NUMBERS

![]() 800MW

800MW

Added to the Electricity Grid in SA from Kusile unit 5

4.25%

4.25%

European Central Bank Cuts Rates by 25bps

9

9

Parties included in SA’s Government of National Unity

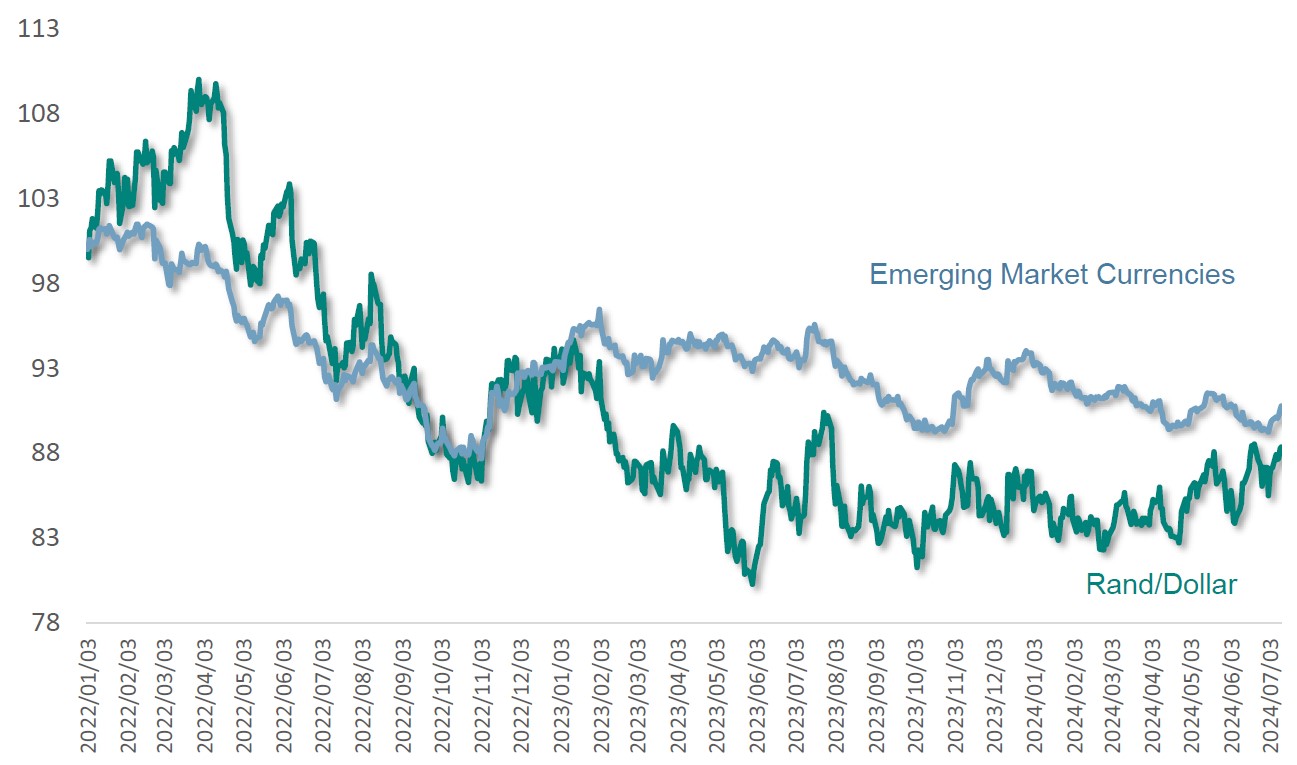

EXCHANGE RATES

EMERGING MARKET CURRENCIES VS THE RAND

EMERGING MARKET CURRENCIES VS THE RAND

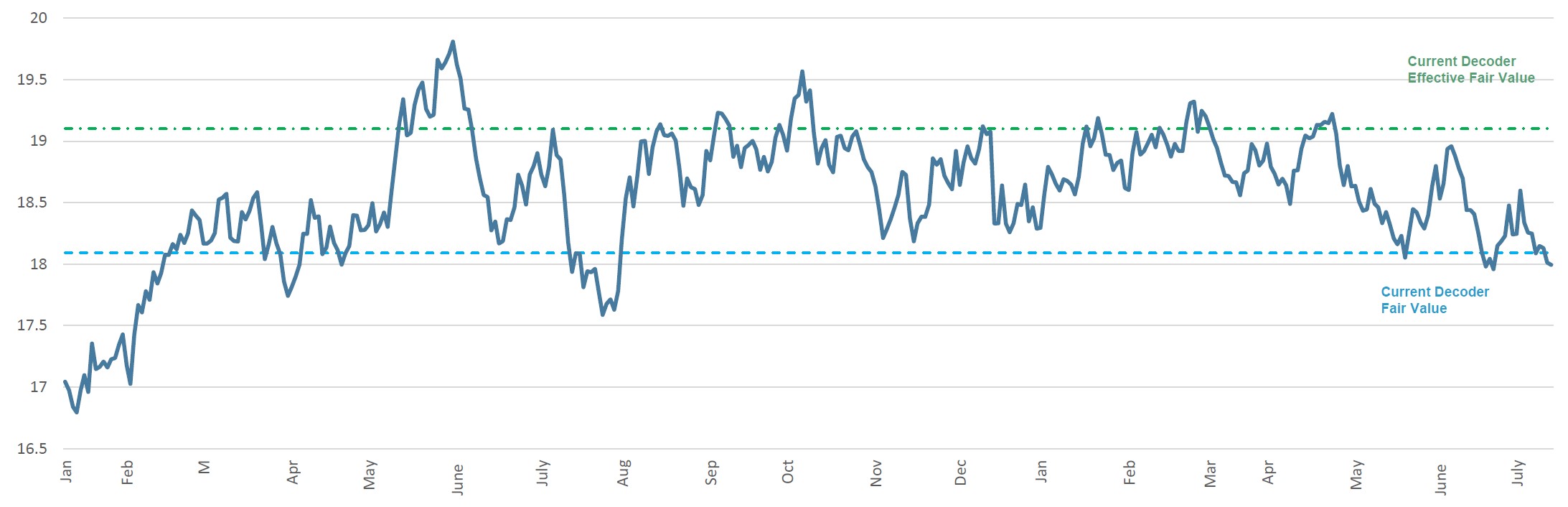

US DOLLAR VS THE RAND

US DOLLAR VS THE RAND

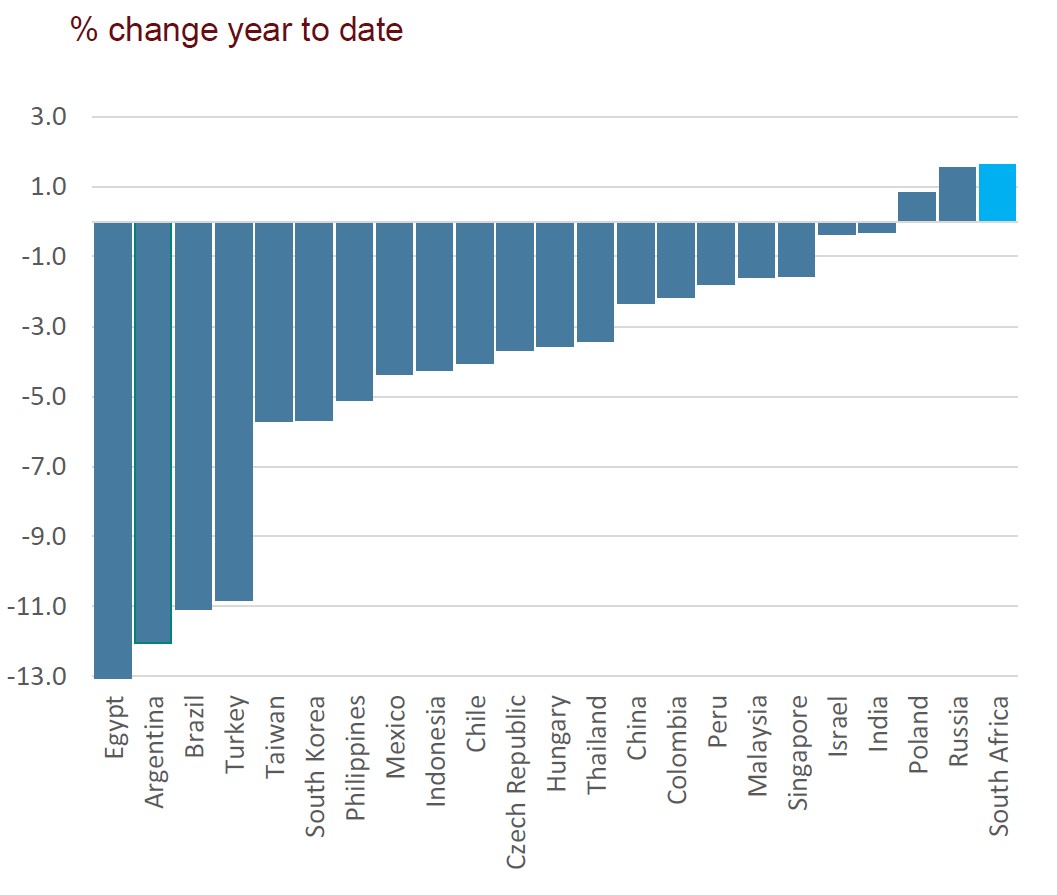

EMERGING MARKET EXCHANGE RATE VS USD

EMERGING MARKET EXCHANGE RATE VS USD

GLOBAL MARKET

_______________________

June brought mixed results across markets, with varied returns in both bond and equity sectors. Bond yields generally fell slightly, boosting fixed income prices as inflation moderated in most regions. Notably, UK inflation dropped to the Bank of England’s target of 2.0% for the first time since 2021.

The Rand continues to benefit from the country’s improved risk premium following the recent formation of the Government of National Unity and its potential to change the trajectory of SA’s growth rate. Political stability and an improved economic outlook are key for sustained Rand strength.

SMARTIE BOX IN RANDS:

LOCAL MARKETS

__________________________

June was an exceptionally favorable month for South African asset classes, highlighted by a strengthening rand, a rally in bond yields, and robust performance in local equities, especially in financials and property stocks.

This optimism stemmed from the election results, where the ANC lost its majority, leading to the formation of a government of national unity. The local market outperformed, becoming one of the top-performing emerging markets for the month, significantly outpacing broader EM indices, which themselves outperformed developed markets.

Due to the stronger rand, global asset classes underperformed despite reasonable returns in hard currency. South Africa’s election outcome was viewed positively by the markets, contrary to the general Emerging Market trend. SA equities enjoyed their strongest month of the year, and SA bonds saw their best monthly performance in four years.

Bond yields dropped by more than 1.0% over the month as investors anticipated greater political stability with the new government. Additionally, the rand appreciated against all major currencies, providing relief to the local net-importing economy, which had been struggling with dollar strength earlier in the year.

MOVEMENTS

- The JSE All Share Index boasted stellar performance in June (up 4.1%).

- Financials (up 14.5%) shot higher, with Industrials (up 1.9%) ending comfortable in the green and Resources (down 3.6%) lagging the local bourse.

- Small-caps (up 6.5%), Mid-caps (up 6.4%), and Large-caps (up 3.7%) all ended the month much stronger.

- The S&P SA REIT sector (up 9.4%) and the SA Listed Property sector (up 6.0%) each gained considerable ground.

- SA Nominal Bonds (up 5.2%) strengthened, and Inflation Linked Bonds (up 3.1%) ended well into positive territory.

- Developed Market Equities came in second to their Emerging Market peers in US Dollar terms, with the MSCI World Index up 2.1% and the MSCI Emerging Market Index having gained an impressive 4.0%.

- The Rand strengthened in June, appreciating against all of the major currencies, apart from the dollar which weakend over the month. Relative to the US Dollar (Rand appreciated 3.0%), the Euro (Rand appreciated 4.3%) and the Pound Sterling (Rand appreciated 3.7%).

- Gold (up 0.2%) had a fairly muted month, as Platinum (down 3.4%) decreased and Brent Crude (up 5.9%) rebounded strongly from May’s pullback.

MONTHLY RETURNS: