Investment Market Update

OCTOBER 2024

What developments have unfolded in local and global markets throughout the month of October?

45%

45%

EU institutes tariffs on Chinese EVs

$2,790 /oz

$2,790 /oz

Gold reaches all time high

2009

2009

The last time Japan’s Liberal Democratic party wasn’t in power

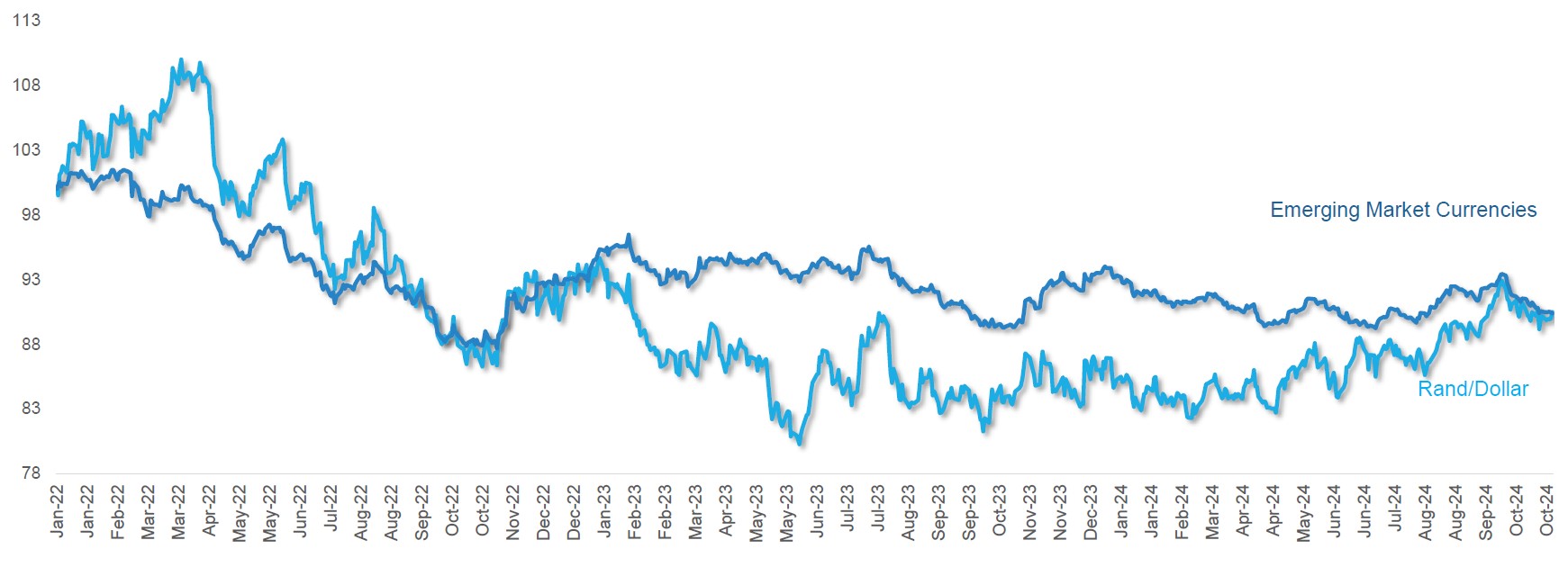

EMERGING MARKETS VS THE RAND

EMERGING MARKETS VS THE RAND

US DOLLAR VS THE RAND

US DOLLAR VS THE RAND

EMERGING MARKET EXCHANGE RATE VS USD

EMERGING MARKET EXCHANGE RATE VS USD

GLOBAL MARKET

_______________________

In October, investors faced a turbulent market environment characterized by notable fluctuations and shifting sentiment. Although the month began on a strong note, equity markets later declined due to stronger-than-expected U.S. economic data.

ANALYTICS - OCTOBER COMMENTARY:

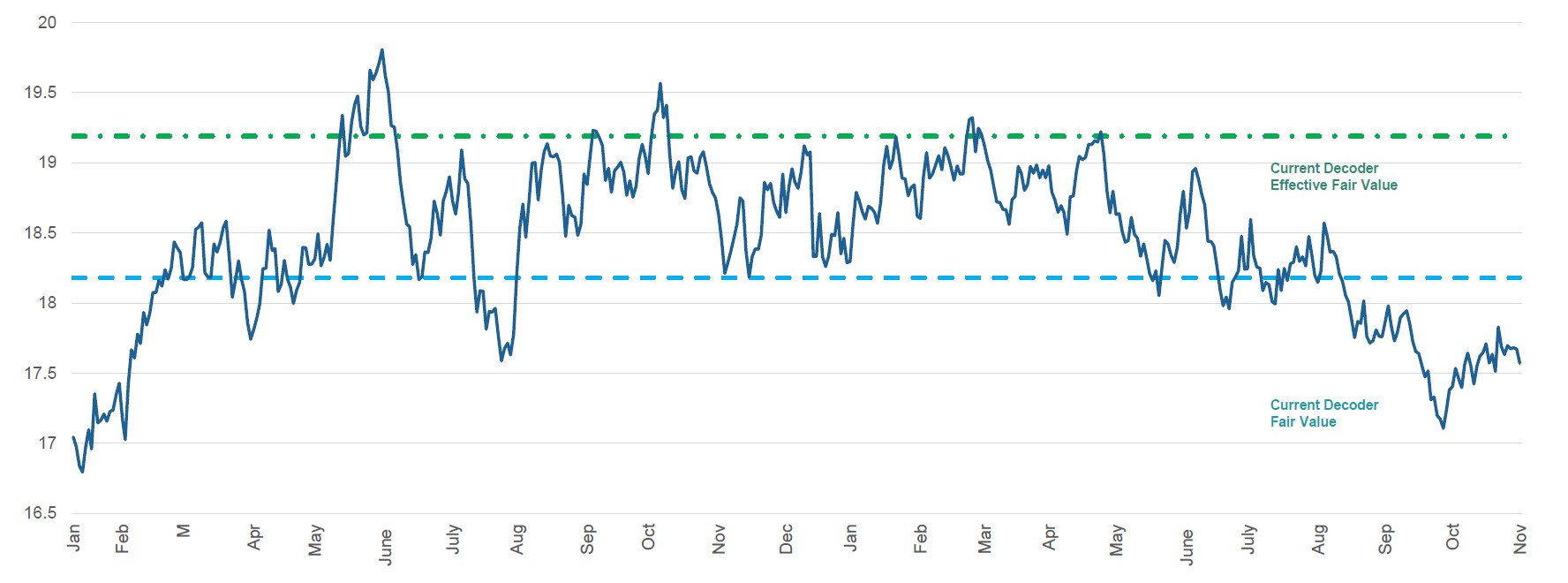

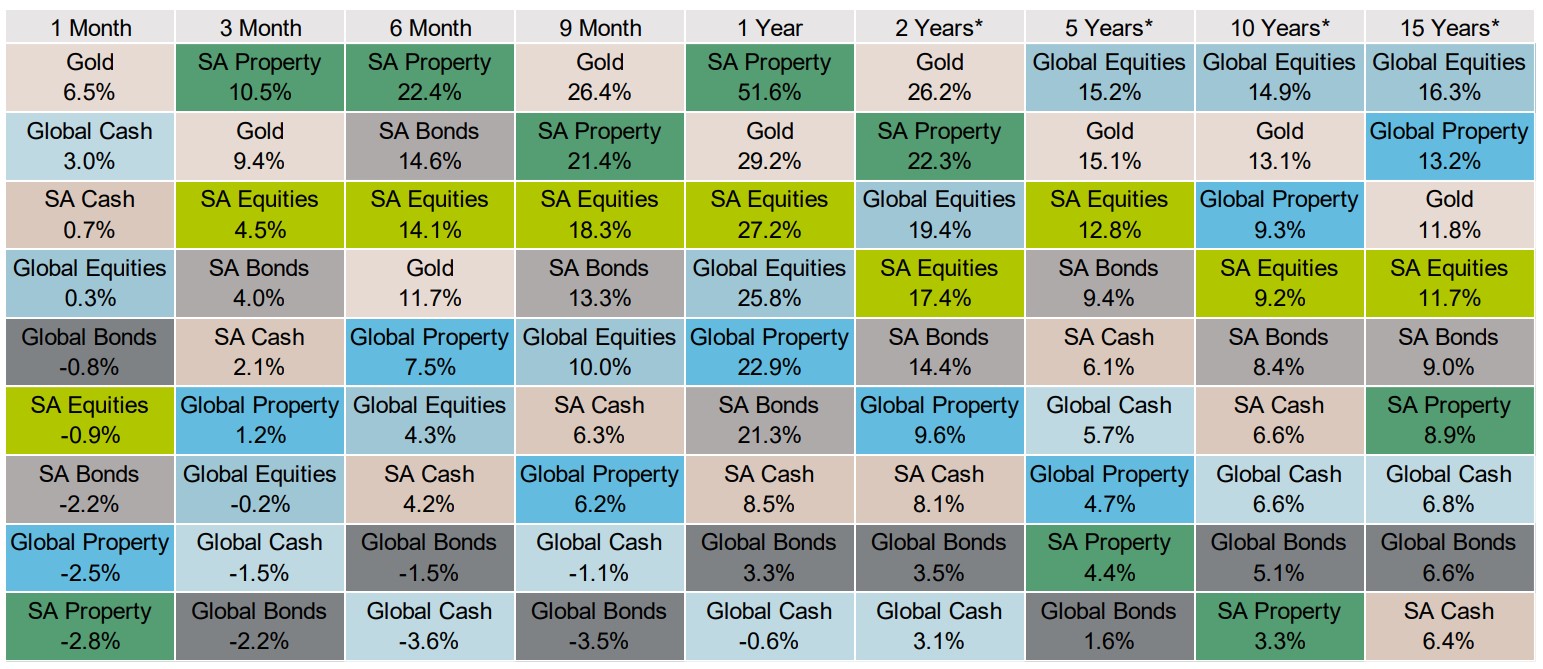

SMARTIE BOX IN RANDS:

LOCAL MARKETS

__________________________

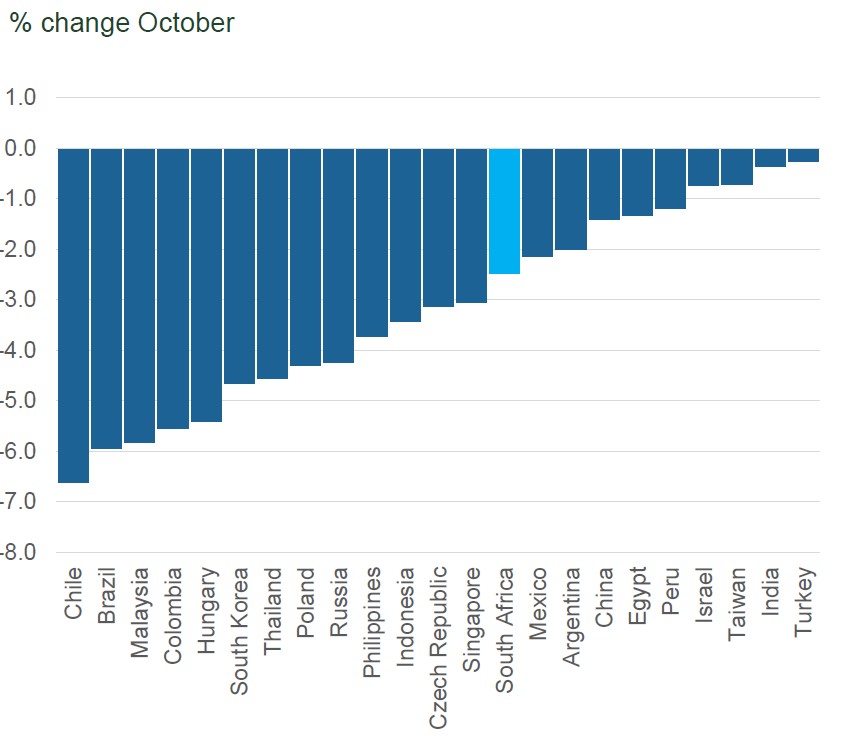

South African equities outperformed the broader emerging markets in October, driven by strong gains in the commodities sector, especially gold stocks.

After four months of declining bond yields and the dissipation of the election risk premium, South African bonds weakened during the month, aligning with trends in global markets. Headline inflation continued to decline, dropping to 3.8%, the lowest level in over three years.

The Medium-Term Budget Policy Statement (MTBPS) was the first fiscal policy announcement since the Government of National Unity (GNU) was formed. Initially, the markets reacted negatively to this risk event, but the downturn quickly stabilized, leaving no lasting impact. Key updates included upwardly revised, though still conservative, growth forecasts and a deeper main budget deficit, while fiscal consolidation remained a priority.

In September, South Africa’s Consumer Price Index (CPI) fell to 3.8%, slipping below 4% for the first time since March 2021. This significant decline in inflation was largely due to lower fuel prices and stable food costs. The current and expected inflation figures have fueled speculation about the South African Reserve Bank’s (SARB) upcoming interest rate decision in November, particularly whether a substantial 50 basis point cut is justified.

Producer Price Index (PPI) data for September showed a year-on-year increase of 1%, the lowest in four years, marking the 13th consecutive month of decline. This data supports the easing trend in overall price pressures, contributing to the deflationary movement seen in the CPI. The PPI decline was primarily driven by falling global oil prices and a stronger rand, though both factors have uncertain futures and present notable risks.

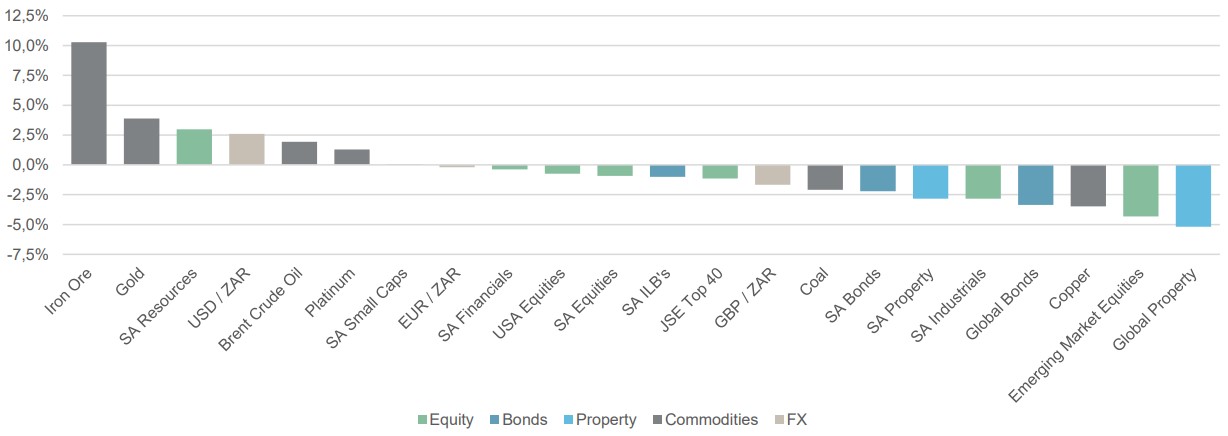

- The JSE All Share Index dipped in the negative (down 0.9%) breaking a streak of seven consecutive months of positive performance.

- Financials (down 0.4%) dipped in the red, while Industrials (down 2.8%) saw a more significant decrease. Resources (up 3.0%) remained in positive territory.

- Small-caps (up 0.1%) and Mid-caps (up 0.5%) managed to remain in positive territory, while Large-caps (down 1.1%) ended the month in the negative.

- Both the S&P SA REIT sector (down 1.5%) and the SA Listed Property sector (down 2.8%) fell over the month.

- SA Nominal Bonds (down 2.2%) and Inflation Linked Bonds (down 1.0%) weakened during October.

- Developed Market Equities outperformed their Emerging Market peers in US Dollar terms, with the MSCI World Index down 2.0% and the MSCI Emerging Market Index down 4.3%.

- Relative to the US Dollar (Rand depreciated 2.6%), the Euro (Rand appreciated 0.2%) and the Pound Sterling (Rand appreciated 1.7%).

- Commodities performed well in October, with Gold (up 3.9%), Platinum (up 1.3%) and Brent Crude (up 1.9%) all achieving positive returns.

MONTHLY RETURNS: